Fsa Qualified Expenses 2024 – FSA accounts have use-it-or-lose-it provisions that require enrollees to spend the funds on qualified expenses before the end of the calendar year the contribution was made. Plan sponsors can . What is an eligible FSA expense? FSA eligibility rules are determined by the Internal Revenue Service (IRS) and Internal Revenue Code section 213(d). FSAs can be used for a wide variety of clinical .

Fsa Qualified Expenses 2024

Source : www.thebossysauce.comFlexible Spending Accounts 2024 | Beverly, MA

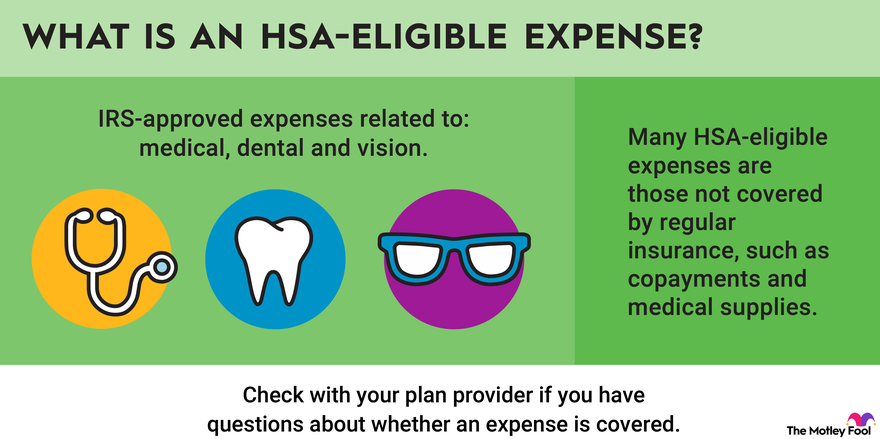

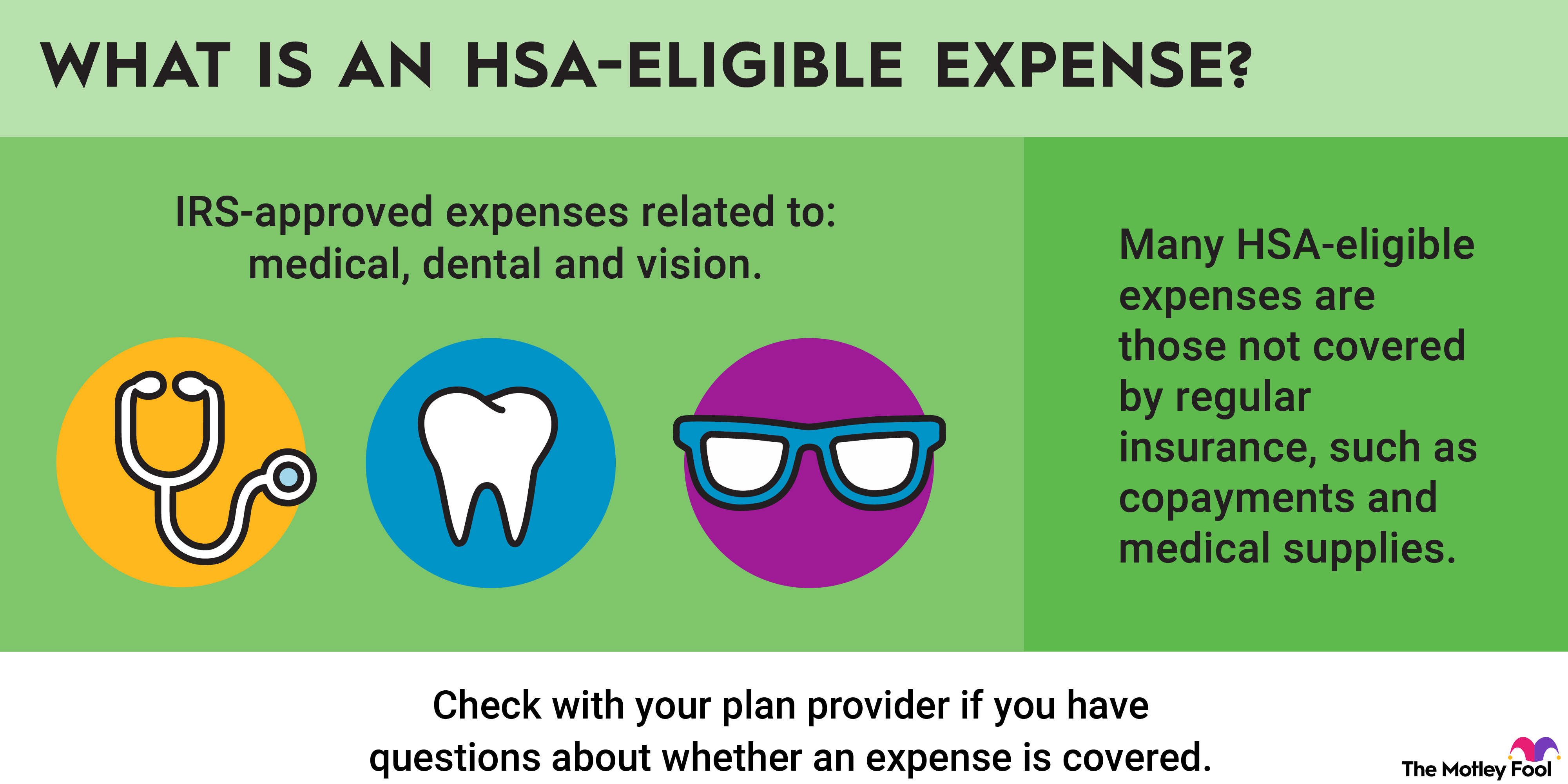

Source : www.beverlyma.govHSA Eligible Expenses in 2023 and 2024 that Qualify for

Source : www.fool.comFlexible Spending

Source : www.trinity-health.orgHSA Eligible Expenses in 2023 and 2024 that Qualify for

Source : www.fool.com2024 FSA Eligible Items & Where To Buy | MetLife

Source : www.metlife.comFlexible Spending Accounts 2024 | Beverly, MA

Source : www.beverlyma.gov2024 HSA, FSA, Retirement Plan Contribution Limits Announced

Source : hrwatchdog.calchamber.comFlexible Spending Account contribution limits to increase in 2024

Source : www.govexec.com2024 FSA Contribution Limit Increases | Wallace, Plese + Dreher

Source : www.wpdcpa.comFsa Qualified Expenses 2024 24 Coolest Wellness & Gadget FSA Finds / HSA Items in 2024; From a : FSA funds do not roll over and withdrawals for qualified medical expenses are also tax-free. Some key advantages of HSAs include: Contributions are tax-deductible or pre-tax. . After a long wait, dairy farmers can begin enrolling in Dairy Margin Coverage program beginning Feb. 28. Payments to begin in early March. .

]]>